What are the requirements of Credit score for VA loan in Houston? Read below to know the requirements of VA loans.

Are you a member of the military or a veteran wanting to purchase a home? If this is the case, there is a unique mortgage loan called a VA loan. These loans include competitively low-interest rates, no down payment, and cheap closing charges. Continue reading to find out what credit score for VA loan in Houston and how this mortgage type may assist you in financing your dream house.

In contrast to typical mortgage loans, VA loans are guaranteed by the United States Department of Veterans Affairs. These loans are created specifically for active serving and former military members. These loans may help certain surviving spouses in addition to service members and veterans. You are eligible for a VA loan if you are the surviving spouse of a veteran who died on duty or from a service-related disability and has not remarried.

Your lender will assess your credit, debt, and income, just like any other mortgage application, to decide if you qualify for a VA loan. These elements will also influence the interest rate you obtain.

Debt-to-Income Ratio

A VA mortgage allows for a maximum debt-to-income ratio of 41 percent. Provided your DTI ratio is greater, you may still be accepted if you have enough “residual income.” This is the amount of money left over after the mortgage payment to cover basic living needs. Pay down debt if you have a high DTI ratio to lower your percentage. Having a VA mortgage loan cosigner may also boost your chances of approval, depending on your financial and credit position.

Credit Requirement

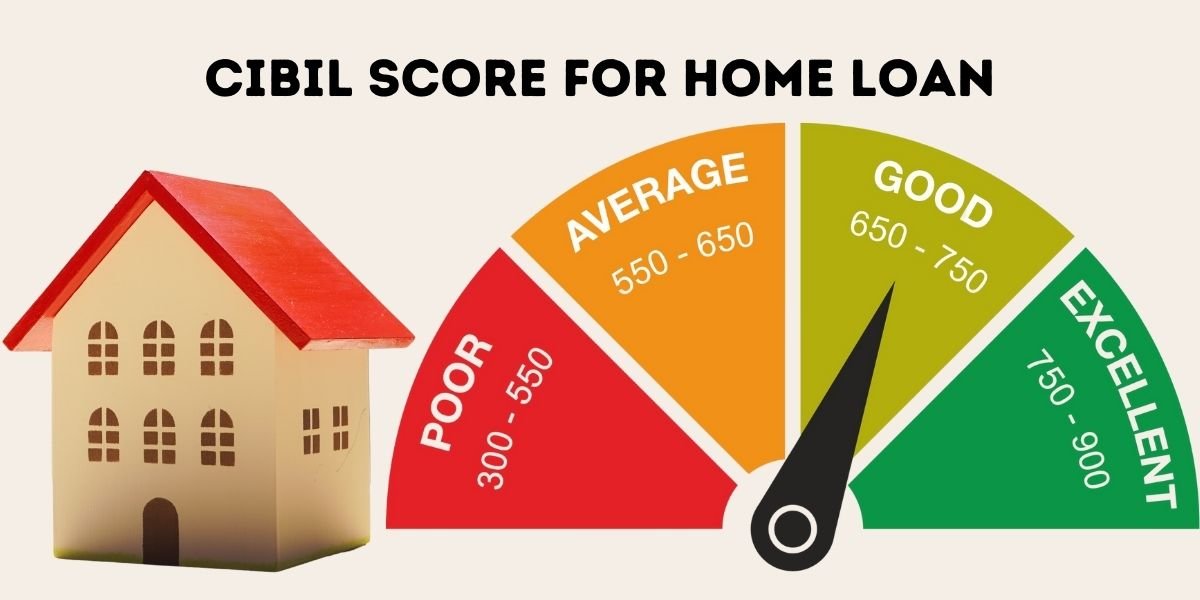

There is no minimum credit score required for service personnel and veterans to be eligible for a VA loan. However, VA mortgage lenders can set their own minimal FICO score requirements. Most lenders want a score in the mid-600s or above. If your credit score is less than 630, you should work on improving it before applying for a VA loan. Your lender will also review your credit report to confirm that you have a history of making on-time payments.

If you’ve never bought a house before, or if you’ve never used a VA loan, it might be difficult to find the correct lender on your own. To get your house loan, you’ll need to engage with a reputable lender that understands how to overcome negative credit and work with the Veterans Administration. A lender that is sensitive to the requirements of veterans wants to offer credit to as many veterans as possible, understanding that the lack of a particular credit score required for a VA loan was selected to assist veterans who face different problems than others when purchasing a house.